One big theme from the interviews I conducted on my recent African trip is that tax officials in developing countries are really starting to raise concerns about some of their tax treaties. This is particularly true of treaties with the Netherlands, Mauritius and other countries that can leave them vulnerable to treaty shopping, although it… Continue reading Learning from past mistakes in tax and investment treaties

Category: Tax treaties

Capital gains tax avoidance: can Uganda succeed where India didn’t?

I’m writing this post from under a mosquito net on a close Kampala evening. Since arriving on Wednesday I’ve had a whistlestop tour of the issues facing Uganda as it embarks on a review of its tax treaties. So far I’ve met with four tax inspectors, two finance ministry officials, four (count ’em) tax advisers,… Continue reading Capital gains tax avoidance: can Uganda succeed where India didn’t?

Time we scrutinised China’s tax treaty practice, too

On Monday the UK parliament took a total of 17 minutes to scrutinise new tax treaties with Zambia, Iceland, Germany, Japan and Belgium. I’ve complained before about how paltry these debates tend to be, and was all set for another blog along those lines. There was, indeed, much to grumble about. No questions from the… Continue reading Time we scrutinised China’s tax treaty practice, too

Do tax treaties affect foreign investment? The plot thickens

I’m at Allison Christians’ brilliant Tax Justice and Human Rights Symposium. Yesterday I began my presentation, as I usually do, by discussing the link between tax treaties and foreign direct investment (FDI). I wrote about this a while ago, but since then I’ve found some more research on the topic. It’s not as simple as… Continue reading Do tax treaties affect foreign investment? The plot thickens

Legislative scrutiny of tax treaties: compare and contrast the UK and US

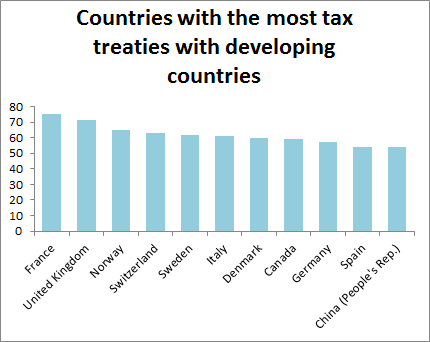

Here’s an interesting chart. Do you notice anyone missing? Interestingly, the United States is considerably less keen on signing tax treaties with developing countries than you might expect, given the amount of investment from it to, well, most places. Its only treaty with the whole of sub-Saharan Africa is with South Africa. When I looked… Continue reading Legislative scrutiny of tax treaties: compare and contrast the UK and US

Thoughts on Deloitte and the China-Mauritius-Mozambique route

Sunday’s Observer carried a story, prompted by ActionAid, based on a presentation given by Deloitte to a group of Chinese investors. The presentation explained how to avoid withholding tax and capital gains tax in Mozambique by routing the investment through Mauritius. It’s great to see this kind of common or garden tax arbitrage highlighted and… Continue reading Thoughts on Deloitte and the China-Mauritius-Mozambique route