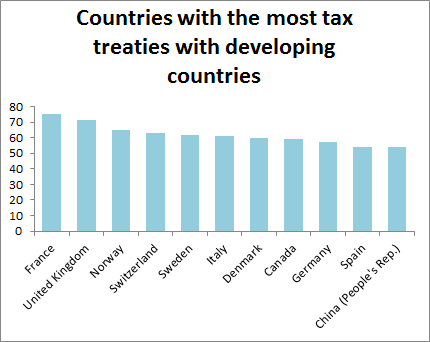

Here’s an interesting chart. Do you notice anyone missing? Interestingly, the United States is considerably less keen on signing tax treaties with developing countries than you might expect, given the amount of investment from it to, well, most places. Its only treaty with the whole of sub-Saharan Africa is with South Africa. When I looked… Continue reading Legislative scrutiny of tax treaties: compare and contrast the UK and US

Category: The politics of international tax

Some political questions for Unitary Taxation

It sometimes feels like, when discussing unitary taxation [pdf], one is expected to self-identify as either a UT advocate, interested in how it could be made a reality, or a sceptic, determined to defend the status quo. I’m neither. As a political scientist, I want to understand (among other things) how our international tax instruments… Continue reading Some political questions for Unitary Taxation

Thoughts on Deloitte and the China-Mauritius-Mozambique route

Sunday’s Observer carried a story, prompted by ActionAid, based on a presentation given by Deloitte to a group of Chinese investors. The presentation explained how to avoid withholding tax and capital gains tax in Mozambique by routing the investment through Mauritius. It’s great to see this kind of common or garden tax arbitrage highlighted and… Continue reading Thoughts on Deloitte and the China-Mauritius-Mozambique route

Is tax treaty arbitration really a bad thing for developing countries?

I’m at the United Nations tax committee annual session this week, where I’ve learnt that I have to be careful what I write here, after a couple of posts from this blog were included in an input document [pdf]. Erk! I’ve been taking the opportunity to discuss with delegates the recent article [£] by the… Continue reading Is tax treaty arbitration really a bad thing for developing countries?

Double tax treaties: a poisoned chalice for developing countries?

It’s been an interesting couple of days here at Strathmore University Business School in Nairobi. I’m at a conference to launch the School’s new Tax Research Centre, which has brought together tax officials, tax practitioners and academics to address some critical issues for Kenya, including anti-avoidance, taxing multinationals and tax treaties. The quality of discussion… Continue reading Double tax treaties: a poisoned chalice for developing countries?

Why the US and Argentina have no Tax Information Exchange Agreement

In this new era of automatic information exchange between tax authorities, the United States has come to be seen as the driving force behind the end of tax secrecy. (Although I note that back in 2010 Tax Justice Network said that the US’ FATCA initiative “preserves the essential Tax Haven USA approach – preventing the… Continue reading Why the US and Argentina have no Tax Information Exchange Agreement