In January, the UN tax committee sent out a call for submissions [pdf] to the update of its transfer pricing manual. The subgroup working on this update will be drafting additional chapters on intra-group services, management fees and intangibles, all topics that greatly interest developing countries and civil society organisations grouped around initiatives such as… Continue reading What is the UN tax committee for, anyway?

Tag: BEPS

Oxfam goes for the full Tanzi…but is that far enough?

“Revenue is the chief preoccupation of the state. Nay more it is the state” – Edmund Burke I spent the weekend with some old friends from the development sector. One of them, it now turns out, is working for a public relations consultancy. There was an awkward moment when I explained that I was working… Continue reading Oxfam goes for the full Tanzi…but is that far enough?

BEPS Part 2: international politics and developing countries

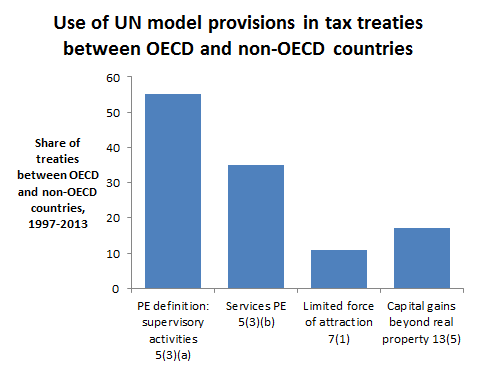

I wrote earlier this week with some questions about UK tax policy and the OECD’s Action Plan on Base Erosion and Profit Shifting. A lot of the areas that it’s looking at are probably not going to affect smaller developing countries very much, but there are a few things worth highlighting. I also recommend Chris… Continue reading BEPS Part 2: international politics and developing countries

BEPS part 1: three places where the Action Plan seems to contradict UK policy

I’ve finally got around to pronouncing on the OECD’s action plan on base erosion and profit-shifting. Surely the only response at this stage is that the jury is out. BEPS is an ordering principle for a quite disparate programme of work, and so it’s hard to reach an overarching verdict. Later this week I’ll write… Continue reading BEPS part 1: three places where the Action Plan seems to contradict UK policy

Base Erosion and Profit Shifting? It takes one to know one

Last week I was at a research workshop for PhD students at the International Bureau for Fiscal Documentation in Amsterdam. It was very interesting to be in the Netherlands in a rather introspective week about the country’s tax treaties. The Netherlands is quite sensitive about the accusation that it’s a tax haven, as I found… Continue reading Base Erosion and Profit Shifting? It takes one to know one

Companies are behaving in precisely the way that our international tax system incentivises them to behave

This is my post published on the LSE Politics and Policy blog last week, written before the corporation tax announcement in the budget. It went down a storm with the UK Independence Party’s Financial Services spokesman: @eurocrat @martinhearson @LSEpoliticsblog Half hearted assertions backed by no evidence. As usual academia with no business acumen — Steven… Continue reading Companies are behaving in precisely the way that our international tax system incentivises them to behave